Government Intervention

Government intervention is one of the major factors that influences how a business behaves in a society. Government intervention is necessary to overcome the shortcomings of corporate self-regulation. After all, government intervention through appropriate policies, regulations and other practices is a response to poor social and environmental business practices. Petersen and Jeppesen (2015) argue that expecting all companies to act as good corporate citizens – something they have been unable to do in the past – would be a little like relying on the fox to watch the hen house.

Companies, which consider CSR as merely a public relations exercise, and companies, that do not give priority to ethics and governance, are unlikely to change behavior unless they are met with government regulations and incentives. Therefore, in order to protect the interests of general public and other segments of society in especially developing countries, the government intervention is inevitable. However, the government intervention should not dampen business activities and reduce overall economic performance of the country while protecting the interest of general public, customers and other stakeholders.

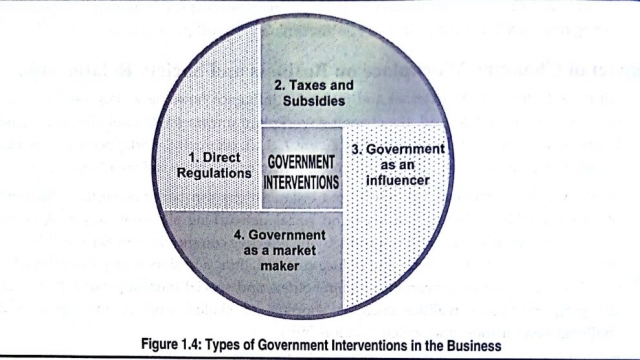

GOVERNMENT INTERVENTIONS ARE:

- Direct Regulations

- Taxes and Subsidies

- Government as an influencer

- Government as a market maker

Following are the important government inventions to regulate the business behavior aimed at protecting the interests of different segments of society.

What Types of government intervention in the business

1)Direct regulations

Some degree of direct regulations via. policies, acts, rules and regulations are essential for modern markets to function effectively and support wider social goals. Regulations are potentially important to protect the interests of employees, customers and other stakeholders. Examples of some important regulations in Nepal are Labour Act, 2017, Trade Union Act, 1992; Child Labour Act, 2000; Labor Policy, 1999; Consumer Protection Act, 1999; Black Market and Some Other Social Crime and Punishment Act, 1997; The Patent, Design and Trade Mark Act, 2006; Copyright Act, 2002; Copyright rules, 2004; Companies Act, 2006; Environment Protection Act, 1996; and Industrial Enterprise Act, 2016.

Proponents of free market, however, criticize those excessive regulations in the economy creates an unnecessary burden of costs for businesses – with huge number of administrative hassles damaging the competitiveness of business.

2)Taxes and Subsidies

Direct taxes (such as corporate tax and income tax) as well as indirect taxes (such as VAT, excise custom duty) are the major sources of government revenue. Government can, later on, v to develop infrastructures, control pollution, and meet various social goals (such expenses).

- Likewise, subsidies can be used to increase financial support for as social security expenses).

- Likewise, subsidies can be used to increase, financial support for high growth small business.

- Common types of subsidies include direct grants, tax exemptions, high growth small businesses.

- Common types of subsidies include direct grants, tax nation, capital injections, equity participation, soft loans, and guarantees.

3)Government as an Influencer

Government may make intervention by influencing consumer behavior as well as businesspersons indirectly. Government attempts to change consumer behavior where such behavior has adverse effects on society or consumer himself/herself. An example of such behavior is excessive alcohol consumption which has been linked with antisocial behavior and health risks and imposes significant costs to the police and the health care system. In such a case, for example, alcoholic products can be taxed at a higher rate than other goods to influence demand and consumers under the age of 18 can be banned from consumption, Government can also use advertising campaigns and educational programs to highlight to costs associated with this behavior.

In relation to business behavior, there may be cases were encouraging self-regulation by firms in an industry is seen as an alternative to direct regulation. For example, businesses can agree on certain product quality and environmental standards by signing up to a code. This may produce important benefits for consumers as well as the community. Sometimes, government can provide relevant information, coordinate the activities and even provide guarantees. For example, government can make coordination with manufacturers, electric power suppliers and producers of chargers and provide relevant information to all concerned to develop confidence among them.

4)Government as a Market Maker

The main aim of ‘government as a market maker’ is to harness the power of markets to deliver wider social goals. There are at least two common mechanisms through which government can intervene as a market maker: competitive tendering and tradable permits. Competitive tendering is used primarily in delivery of public services where, without government intervention, markets will not deliver socially beneficial goods and services at reasonable prices, such as water, electricity, health, education, defense etc. In contrast to command-and-control environmental regulations, tradable permits (aka emissions trading scheme) are a mechanism aimed at reducing pollution. Under this, if a firm produces lower emissions than their permits allow for, they may trade these to organizations that need more permits. Those that reduce pollution, thus receive remuneration from firms that produce more pollutants.

FAQ

What are the government intervention:

1. Direct Regulations

2. Taxes and Subsidies

3. Government as an influencer

4. Government as a market maker