Nepal’s insurance industry plays a crucial role in safeguarding individuals, businesses, and assets against unforeseen risks. Whether it’s life insurance, health coverage, or general insurance, these companies provide essential financial protection to Nepali citizens.

Insurance Company in Nepal

Let’s explore the top 40 insurance companies operating in Nepal:

LIFE INSURANCE COMPANIES

Life insurance companies provide financial protection to individuals and their families. When you purchase a life insurance policy, you pay regular premiums to the insurance company. In return, the company promises to pay a specified amount (the death benefit) to your beneficiaries upon your death. This financial safety net helps ensure that your loved ones are cared for financially after you’re gone.

Different companies offer various life insurance policies, including term life, whole life, and universal life insurance. These policies serve different purposes and cater to diverse needs. Remember, choosing a reputable and reliable life insurance company is essential to safeguard your family’s future.

1. Rastriya Beema Sansthan : View Website

2. National Life Insurance Co. Ltd.: View Website

National Life Insurance Company Limited (formerly known as National Life & General Insurance Co.Ltd.) was incorporated in 1988 A.D. under the Nepal Company Act 1964 and the Insurance Act 1968 of Nepal with the prime objective of meeting the growing insurance requirements of the country.

For more than three decades, National Life has built a reputation as a company that believes in the highest level of customer service. The company’s well-known name and good reputation are reinforced by our commitment to delivering value and service to all who do business with us.

Supporting these efforts are the National Life’s core values of professionalism, transparency, trustworthiness, and honesty. These values are central to the company’s efforts to achieve its vision – to build financial freedom for all – the company remains committed to the highest standards of ethics and integrity.

Capital/Shareholding Share Structure:

Presently the company has paid up capital of around Rs.5011 million. National Life has a very sound shareholding structure as given below.

| Shareholder’s Category | Previous | Current |

|---|---|---|

| Nepalese Promoters | 45% | 45.43% |

| Foreign Collaborator | 10% | 1.11% |

| Financial Institution Rastriya Banijya Bank | 10% | 8.46% |

| Public Shareholders | 35% | 45% |

| Total | 100% | 100% |

It is a listed company with approximately 25000 public shareholders and its shares of Rs. 100 each is being traded substantially above the face value.

Business Philosophy:

National Life is a leading life insurance company in Nepal, committed to offering financial solutions that provide all the security one needs for the family. Ensuring world-class solutions by offering customized products with transparent benefits supported by the best technology is the company’s business philosophy.

Some Financial Highlights:

The Company’s Life Fund size is around Rs. 57 Billion. It has prime properties in various cities of the country and a modern multi-story commercial complex is planned for construction on its land in Lazimpat, Kathmandu. It has a substantial share of investment in many financial institutions, the value of which has increased many folds. Its annual premium collection stands at around Rs. 15 Billion and the company has provided insurance cover to more than 900,000 people.

Management:

National Life is managed and headed by Executives having long-standing experience, thus clients are assured of Class One professional services.

Contact Information

NATIONAL LIFE INSURANCE COMPANY LIMITED

Contact Information

P.O. Box: 4332, Lazimpat, Kathmandu, Nepal.

Tel: 977-1-4514799, 4516556, 4514803, 4535636; Fax: 977-1-4535633

Email: [email protected]; Website:www.nationallife.com.np

FAQ

- What is National Life Insurance Co. Ltd.?National Life Insurance Co. Ltd. (formerly known as National Life & General Insurance Co. Ltd.) was incorporated in 1988 AD under the Nepal Company Act 1964 and the Insurance Act 1968 of Nepal with the prime objective of meeting the growing insurance requirement of the country.

- What is life Insurance?Life Insurance is an agreement that guarantees payment of a stated amount of monetary benefits at the end of a specified term or on the death of the life insured. Different life policies have different features.

- Why life insurance?Life Insurance is usually intended to provide mainly following benefits. For financial security in the event of death or on the inability to earn due to physical disabilities

- To provide for old age

- To safeguard your child’s higher education

- To get income tax benefit

- What type of policies does the company sell?The company is offering various traditional with profit endowment/anticipated policies like Jeevan Amrit, Sabhadhik Amrit, Amrit Barsha etc. It is also offering term policies, pension plans, micro insurance products etc.

- How can I buy life insurance policy?Please browse through our products section of our website and select a plan that suits your needs. If there is any confusion, please contact any of our Branch Office.

- What are the eligibility criteria for life insurance?The eligibility criteria for each plan we provide might be different. Please visit our product link to find details. Entry age, medical conditions, source of income among others are considered for eligibility.

- What are the necessary documents for life insurance policy?Completed policy proposal form, medical report and proof of date of birth are minimum required documents. The other documents may be needed depending on type of insurance, sum insured etc.

- What is group insurance policy?Group policy is single Insurance policy purchased by a company for its specified staff.

- Do I need a personal life insurance policy if I have group coverage?A group policy generally covers until you are employed. The cover may also be limited. After leaving company you might not have coverage. However, personal life policy assures adequate coverage regardless of your employment and may provide coverage after retirement.

- If I take an Individual insurance in addition to the group, do I get any extra benefit? They are two separate covers and you can get both benefits.

- Do I need life insurance for my child? There are great advantages, to purchasing a policy for your child. Insurance premiums increase with age. Therefore it will be beneficial to purchase an insurance policy at low premiums for a long period. This will prepare them for a more financially secure future.

- What is beneficiary/ nominee?This is a person(s)/party(ies) designated to receive life insurance or annuity proceeds upon the death of the insured. The beneficiary is named when a policy is taken out and can be changed at the request of the policy owner.

- Do I have to select nominee\beneficiary? Whom can I select as nominee / beneficiary?Nomination facilitates speedy settlement of claim in event of unfortunate death of assured. Name of the nominee should be clearly mentioned in the Proposal Form. In case of any changes, please ensure to update new Nominee’s Name in our records. Any close relative or any one you choose can be selected as nominee.

- Where are offices of National Life Insurance Company Limited?We have offices and personal advisers (agents) all over Nepal. Please click here to find closest to your location.

- What facilities are provided at branch offices? Can I pay premium at the branch?Our branch office provides service regarding premium collection, policies issue, etc. You can pay premium at any branch of the company.

- Do I get an acknowledgement of any premiums paid?We provide you with a receipt of payment. We also send text message with acknowledgement of payment to all policyholders who provide us their mobile number.

- What will happen if I stop premium payment?Policies lapse if premium is not paid within policy time. In such cases, policies may earn paid up value under given circimstances but shall not have other benefits like death claims etc.

- How lapsed policy can be revived?For reviving lapsed policies within 3 Years of lapse date the person will have to show he is medically fit to continue the policy. He will also have to pay interest charges. The company may also demand suitable documents to ensure that policy can be revived.

- Is there difference in purchasing policy from the company or from agent?No, there is not much difference. However an agent can provide after sales services to a client.

- Can sum assured be added or deducted?No, sum assured cannot be changed. Howeveradditional policy can be purchased after fulfilling specified criteria.

- What is bonus? How is it paid?Profit earned by insurer in the process of running insurance company is bonus. It is paid in the event of death of policy holder or maturity of policy, whichever occurs first, incase of with profit policies.

- What is provision for lost policy?In case a policy is lost, you must immediately apply for duplicate copy. You will have to pay necessary charge for duplicate policy being issued. Since policy document are crucial legal agreement, it is advised that they be preserved with utmost care.

- How do I update my personal details?You will have to submit an application in one of our branches with necessary details.

- How do I make a claim?The policyholder should apply for maturity claim, among others, with original policy, last premium receipt, signed claim discharge voucher etc. For claim death, among others, death certificate, relationship certificate, death registration certificate etc are needed. You may contact any of our branches for full details.

- Can a policy be changed to another?No, a policy once issued cannot be changed.

- Can the premium be refunded, if the policy is discounted? No, the premium will not be refunded but if the policy had run for a minimum of two years, the surrender value as specified may be received.

- Can I take loan against policy ? A policyholder can receive loan against a policy that has earned surrender value. Surrender Value is calculated as per method specified by Beema Sami

3. Nepal Life Insurance Co. Ltd.: View Website

WELCOME TO NEPAL LIFE INSURANCE COMPANY LIMITED

Nepal Life, established under the Company Act 2053 and Insurance Act 2049 as a public limited company on 2058/01/21 (04/05/2001). Nepal Life is the foremost life insurance company established by private investors. The promoters of the company are a group of well known businessmen and business houses of Nepal. In more than two decades of operation, the Company has set up an excellent business record and has a strong financial position.

VISION AND MISSION

To endeavor through the noble institution of Life Insurance in making every family economically safe and secure whereby every citizen of Nepal may contribute his might in building a healthy, prosperous, strong & Vibrant Nation.

To cater to financial and Social needs of every segment of society by designing differentiated and innovative insurance instruments. To provide after sales service to customers that can be hailed as the best.

HOW NEPALLIFE IS DIFFERENT FROM OTHERS?

Being in the business of selling life insurance products it is performing the same job as the other insurers dealing with “Life Insurance”. However, Nepal Life Insurance Company has its own identity because of the mission and manner for which it is working. The company is working with a time bound strategy to fulfill it’s vision of spreading message of insurance to every home and to contribute substantially in making Nepal an economically healthy and vibrant nation.

Apart from spreading the network of branches all over Nepal the company plans to make a quantum jump in number of agents and to provide them adequate training for providing knowledge and skill, so that the company can reach and depth in the market.

The company is focusing on providing qualitative services of International Standard. Our ambition is to provide across the counter services in all its operations.

This ambition cannot be fulfilled without the help of information technology. The company has strong IT infrastructure. All Branches of NepalLife has been connected through wide area networking to provide better customers service.

4. Life Insurance Corporation (Nepal) Ltd.: View Website

5. Met Life (American Life Insurance Company): View Website

6. Asian Life Insurance Co. Ltd.: View Website

7. Surya Life Insurance Co. Ltd.: View Website

8. Gurans Life Insurance Co. Ltd.: View Website

9. Prime Life Insurance Co. Ltd.: View Website

10. IME Life Insurance Co. Ltd.: View Website

11. Union Life Insurance Co. Ltd.: View Website

12. Jyoti Life Insurance Co. Ltd.: View Website

13. Sun Nepal Life Insurance Co. Ltd: View Website

14. Reliance Life Insurance Co. Ltd.: View Website

15. Reliable Nepal Life Insurance Co. Ltd.: View Website

16. Citizen Lie Insurance Ltd.: View Website

17. Sanima Life Insurance Ltd.: View Website

18. Prabhu Life Insurance Co. Ltd.: View Website

19. Mahalaxmi Life Insurance Ltd.: View Website

NON-LIFE INSURANCE COMPANIES

20. Nepal Insurance Co. Ltd.: View Website

21. The Oriental Insurance Co. Ltd.: View Website

22. National Insurance Co. Ltd.: View Website

23. Himalayan Everest Insurance Insurance Co. Ltd.: View Website

24. United Insurance Co. (Nepal) Ltd.: View Website

25. Premier Insurance Co. (Nepal) Ltd.: View Website

26. Neco Insurance Ltd.: View Website

27. Sagarmatha Insurance Co. Ltd.: View Website

28. Prabhu Insurance Ltd.: View Website

29. IME General Insurance Ltd.: View Website

30. Prudential Insurance Co. Ltd.: View Website

31. Shikhar Insurance Co. Ltd.: View Website

32. Lumbini General Insurance Co. Ltd.: View Website

33. NLG Insurance Ltd.: View Website

34. Siddhartha Insurance Ltd.: View Website

35. Rastriya Beema Co. Ltd.: View Website

36. Sanima General Insurance Ltd.: View Website

37. Ajod Insurance Ltd.: View Website

38. General Insurance Co. Nepal Ltd.: View Website

REINSURANCE COMPANIES

39. Nepal Reinsurance Co. Ltd.: View Website

40. Himalayan Reinsurance Ltd.: View Website

FAQ

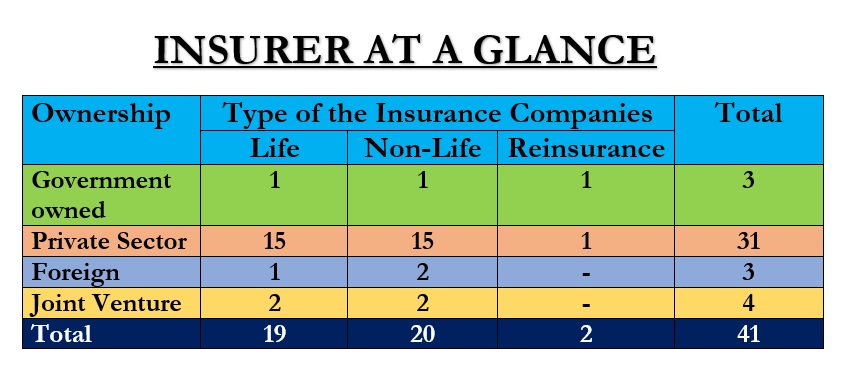

How many insurance companies are in Nepal?

How many insurance companies are in Nepal?

Insurance companies in Nepal are regulated by Nepal Beema Pradhikaran (Nepal Insurance Authority), an arm of Nepal Government’s Ministry of Finance. As of November 2024, a total of 42 insurance companies are offering Life, Non-Life (General), Micro and Re-insurance services.

Who is the top 10 insurance company?

1

MetLife-American Life Insuance Company Limited

ALICO

01-5970166

[email protected]

https://www.metlife.com.np/en/

2

Asian Life Insurance Company Limited

ALICL

01-4410115

[email protected]

https://www.asianlife.com.np/

3

Citizen Life Insurance Company Limited

CLICL

01-5316000

[email protected]

https://citizenlifenepal.com/

4

Gurans Life Insurance Company Limited

GLICL

1660-01-44400

[email protected]

http://guranslife.com/

5

IME Life Insurance Company Limited

IMELICL

01-4024071

[email protected]

https://imelifeinsurance.com/

6

Jyoti Life Insurance Company Limited

JLICL

01-4445941/42

[email protected]

https://jyotilife.com/?lang=np

7

Life Insurance Corporation Nepal Limited

LICN

01-4012613/14

[email protected]

http://www.licnepal.com.np/

8

Mahalaxmi Life Insurance Company Limited

MLICL

01-4445740/41/42

[email protected]

https://mahalaxmilife.com.np/

9

National Life Insurance Company Limited

NLICL

01-4414799

[email protected]

https://nationallife.com.np/

10

Nepal Life Insuracnce Company Limited

NLIC

01-4169082/83

[email protected]

http://nepallife.com.np/

Which is the No 1 life insurance company in Nepal?

Nepal Life Insurance is the largest life insurance company of Nepal in terms of paid-up capital. Nepal Life Insurance has a capital of Rs. 7.19 Arba. Likewise, National life insurance has a capital of Rs 3.39 Arba. Aug 24, 2021

Which insurance company is owned by the Government in Nepal?

Rastriya Beema Company Limited is the only non-life insurance company owned by the Government of Nepal.